form your llc

LLC Formation Made Simple

Starting your business begins with a solid legal foundation.

Our LLC Structure service helps you register and structure your Limited Liability Company quickly, correctly, and stress-free.

We handle the paperwork, explain the process, and make sure your business is protected from day one.

What’s Included in Our Service

Step-by-step guidance for LLC formation

Filing Articles of Organization with your state

Operating Agreement drafting assistance

EIN (Employer Identification Number) application support

State compliance & annual report reminders

Optional registered agent service

Benefits of an LLC

Personal Liability Protection

Your personal assets are shielded from business debts and legal actions.

Flexible Management

Operate as a single-member or multi-member LLC without rigid corporate rules.

Pass-Through Taxation

Avoid double taxation and simplify your tax filings.

Credibility & Professionalism

Build trust with clients, suppliers, and investors.

Easy Maintenance

Less ongoing paperwork compared to corporations.

frequently asked questions

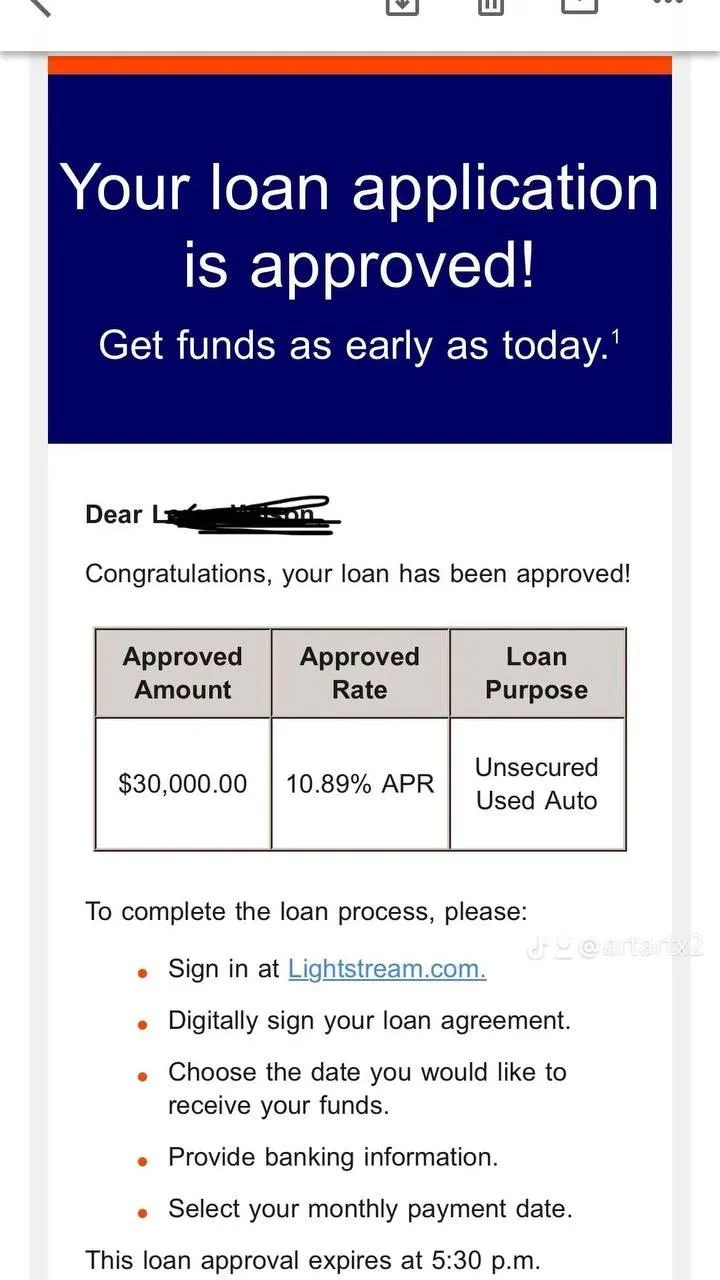

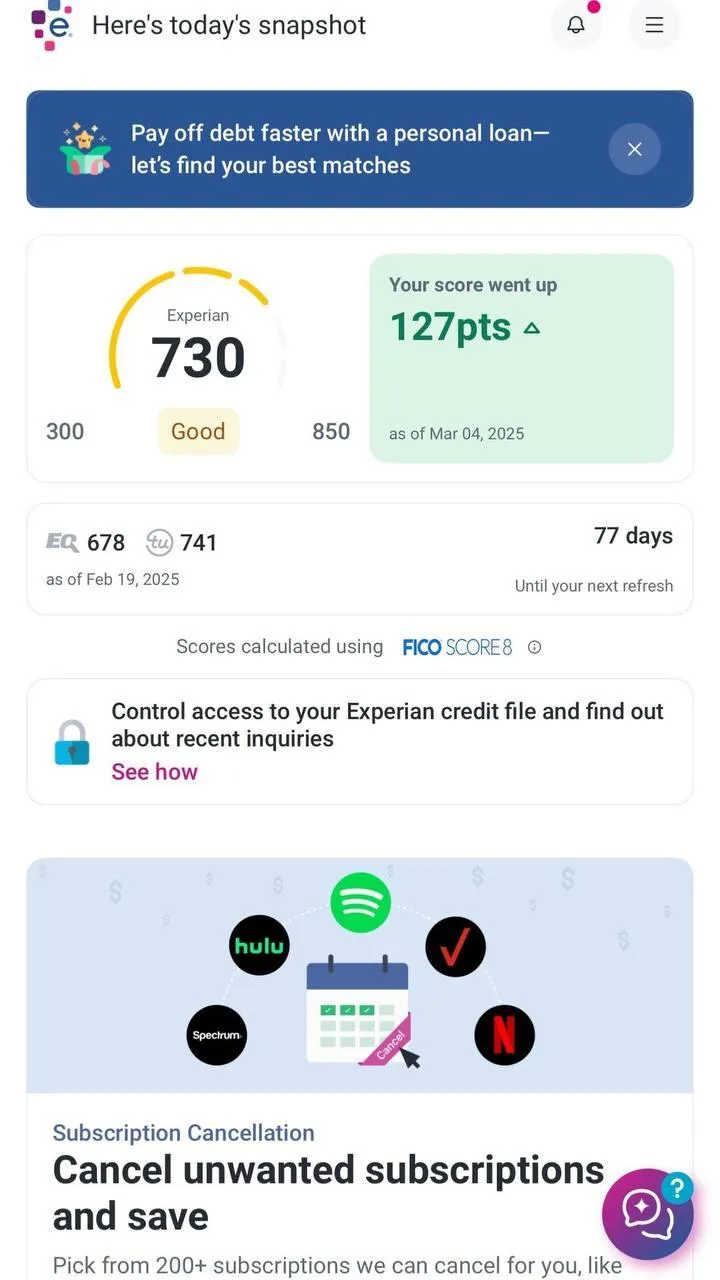

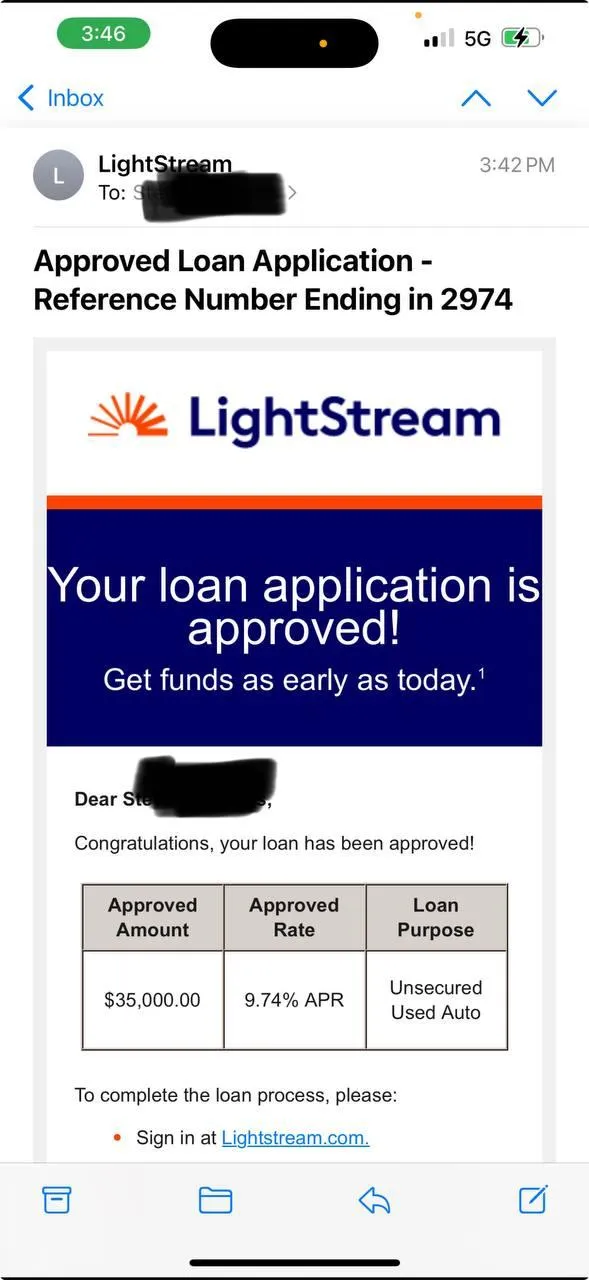

What do I need to qualify for business funding?

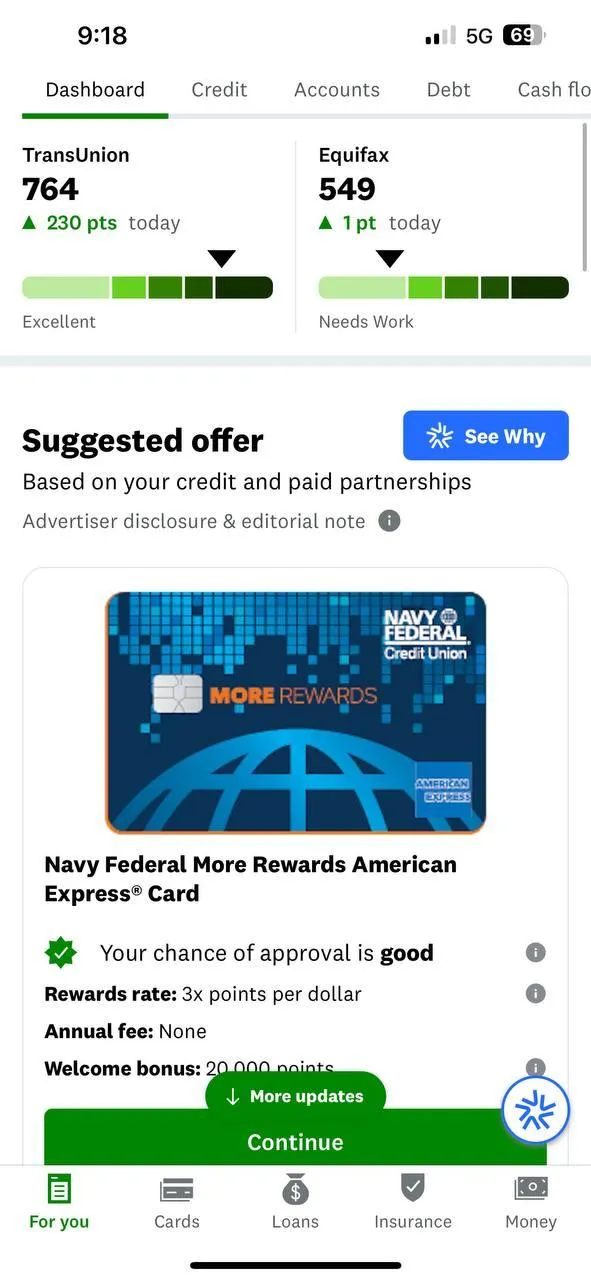

Ideally, a credit score of 680 or higher and proof of income or revenue. If you don’t qualify yet, we’ll guide you through the steps to get there.

Can I get funding even if my credit isn’t perfect?

Yes. Some funding options are available for clients with fair credit or a strong business profile. However, better credit means better terms — and we can help you improve it.

Do you offer both personal and business services?

Yes! We specialize in personal credit repair and business funding. Whether you’re looking to clean up your credit or secure capital to start or grow a business, we’ve got you covered.

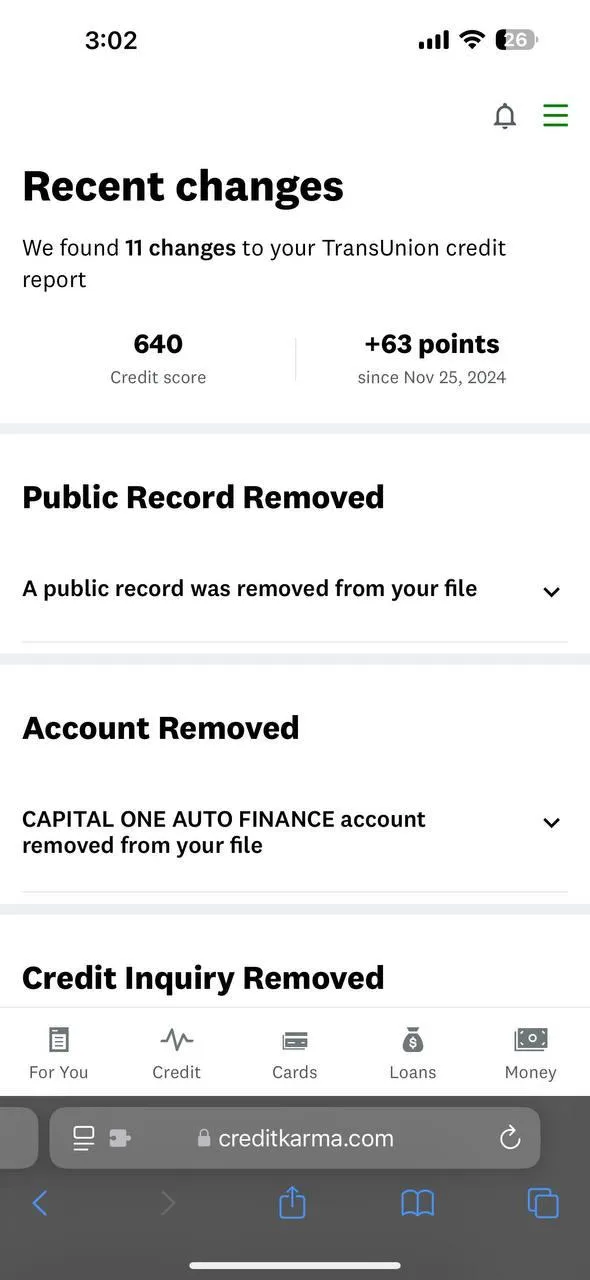

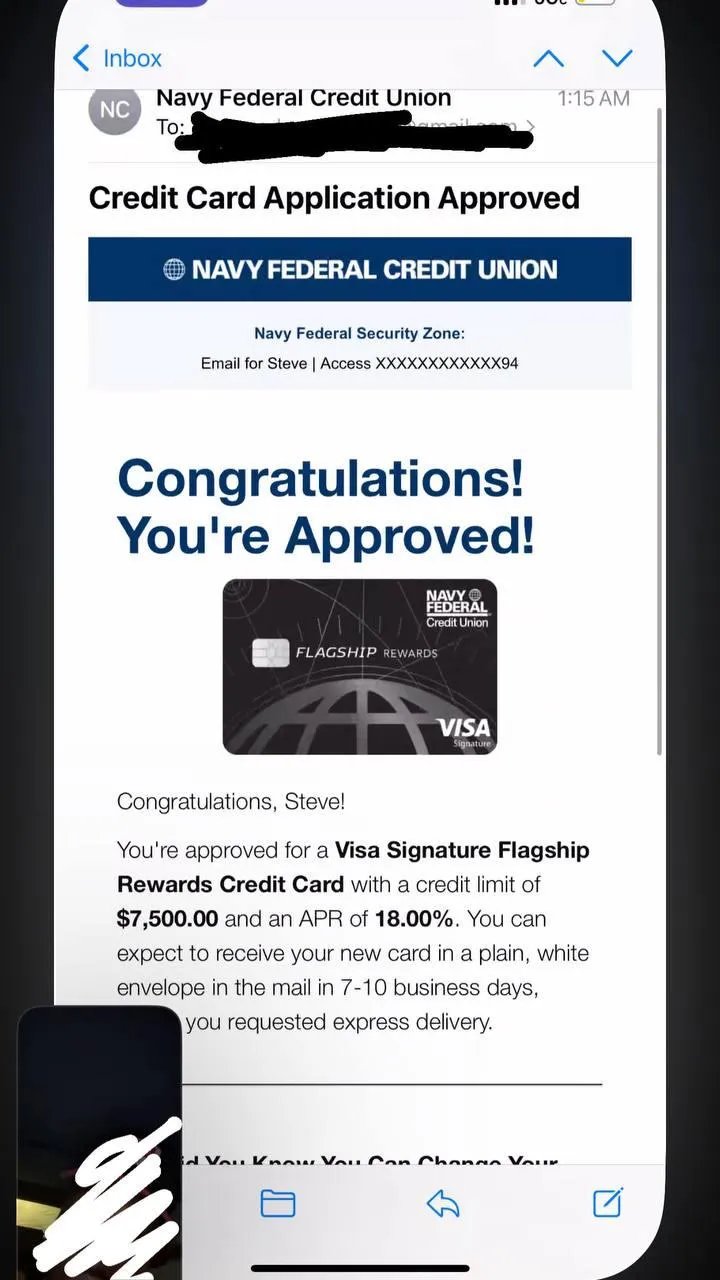

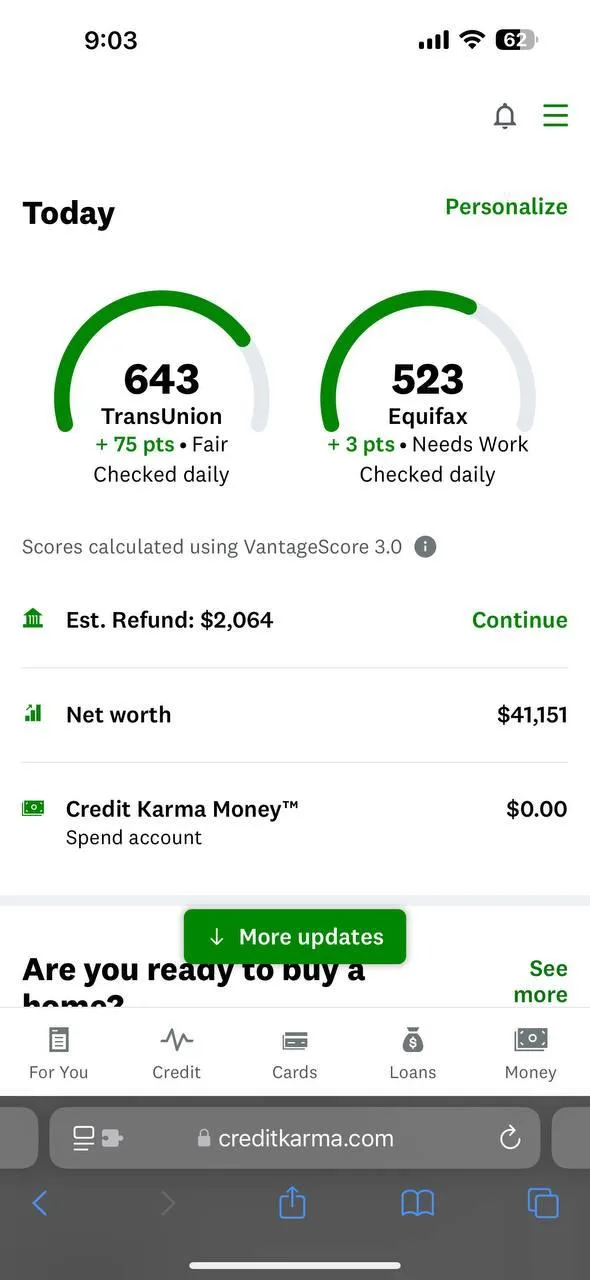

What kind of results can I expect with credit repair?

While every case is different, most clients see a significant improvement in their credit score and the removal of negative items like collections, charge-offs, and late payments.

How long does the process take?

Most credit repair clients see results within 45 to 90 days. Funding pre-qualification takes just a few minutes, and approvals can happen within 3–10 business days depending on the lender.

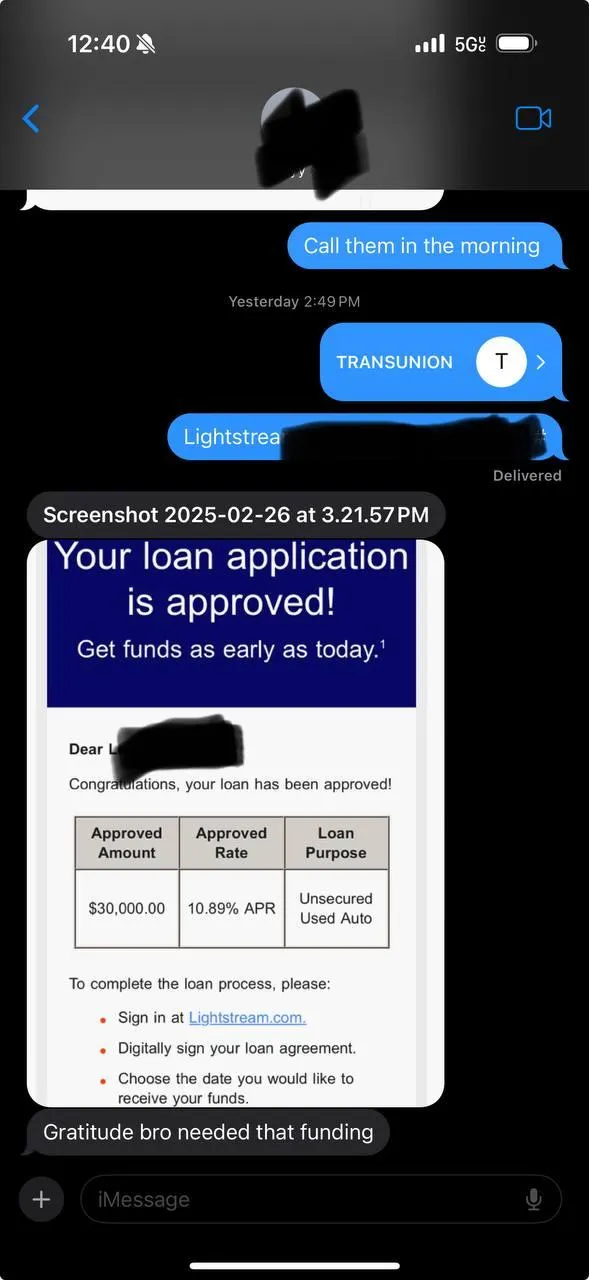

Is the funding really 0% interest?

Yes, many of our approved clients receive business credit lines with 0% interest for 6 to 12 months, depending on creditworthiness and lender terms.

What if I’m not sure where to start?

That’s okay! Just take our free pre-qualification quiz or book a free consultation. We’ll help you figure out the best next step based on your situation.

got questions?

We make it simple. You’ll find answers to the most frequently asked questions from our clients how we’re here to help you grow confidently.

Still don’t see the answer you’re looking for?

Send us a message to get your questions answered directly.

Your Success Story Starts Here

With hundreds of successful outcomes, we’re confident we can help you too.

Ready to be our next result?