fix your credit

Credit Repair That Works for You

Our Credit Repair Program is designed to help you dispute and remove these items, restore your score, and give you the fresh financial start you deserve.

why credit repair matters?

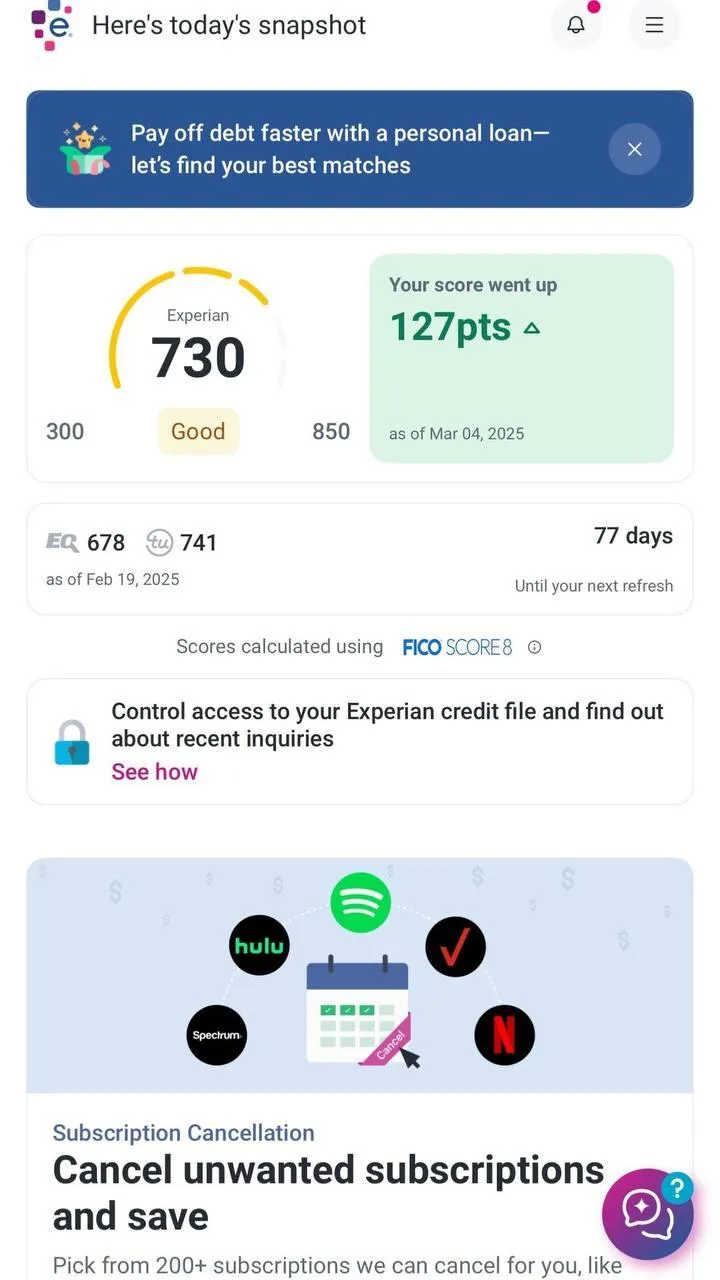

Bad credit doesn’t have to be permanent. Improving your credit score can:

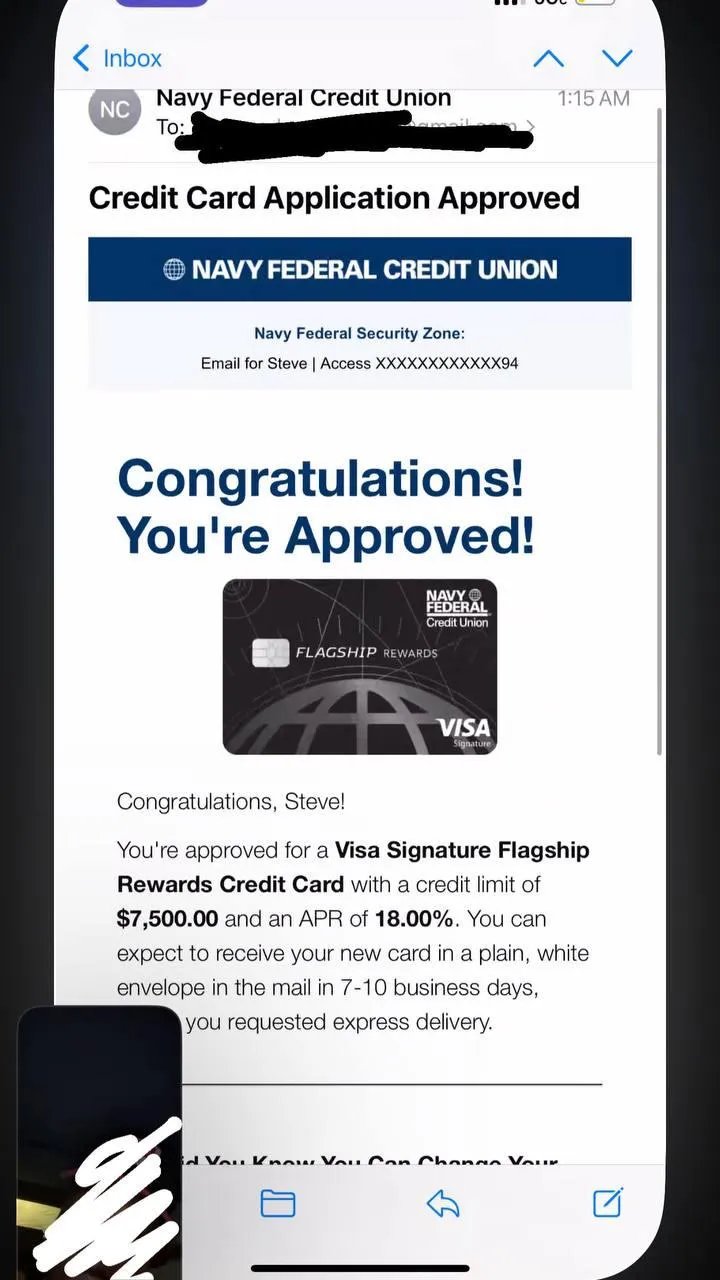

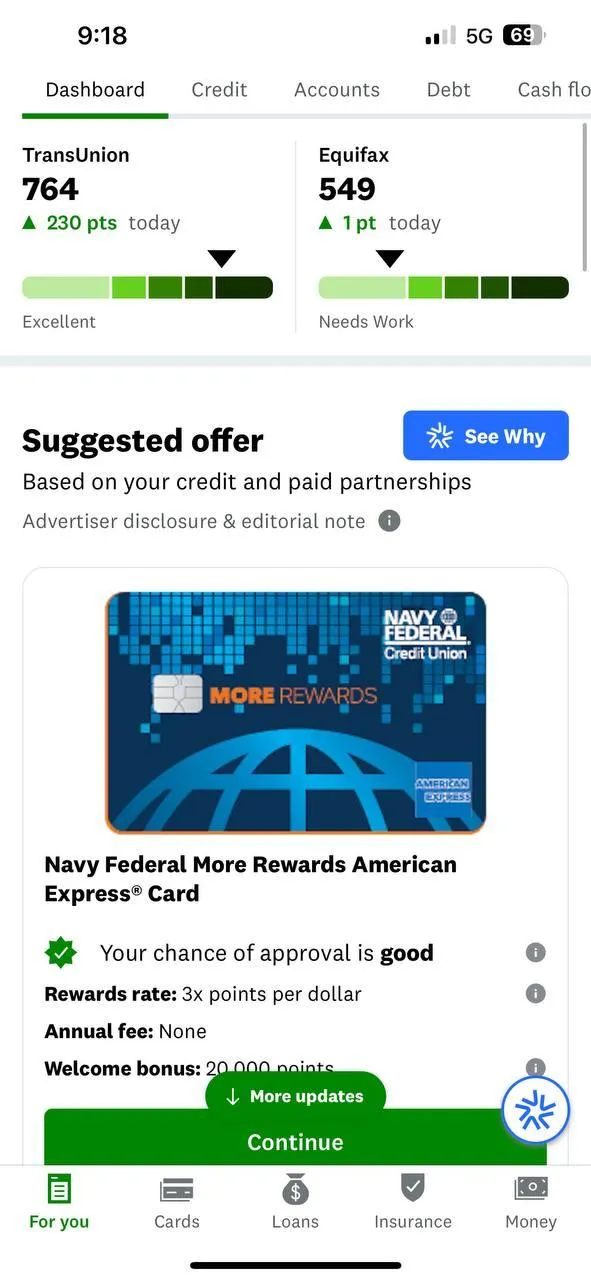

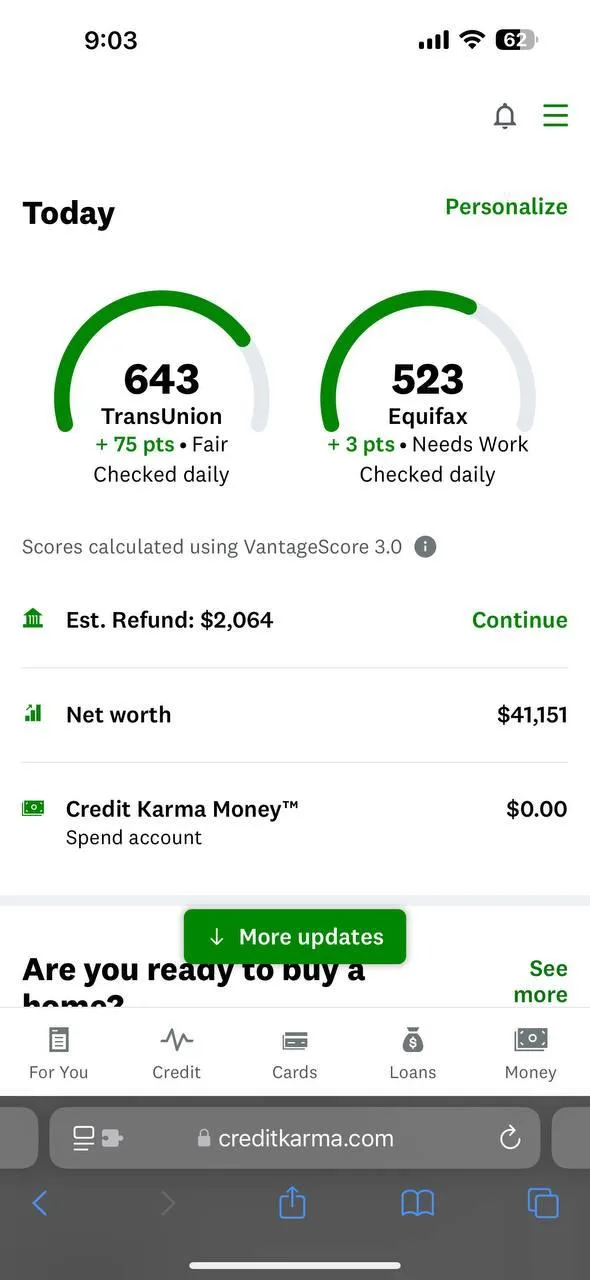

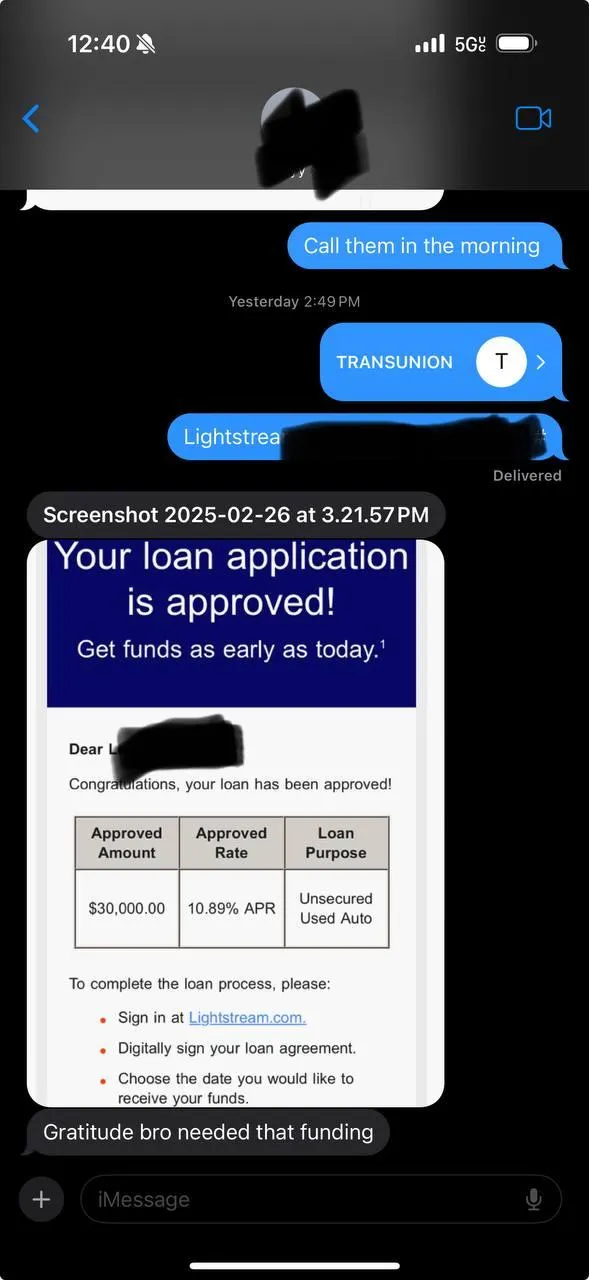

Increase your chances of loan and credit card approval

Secure better interest rates and save money long-term

Unlock higher credit limits for more purchasing power

Help with renting or buying a home

Improve job prospects in credit-sensitive positions

Reduce financial stress and give you peace of mind

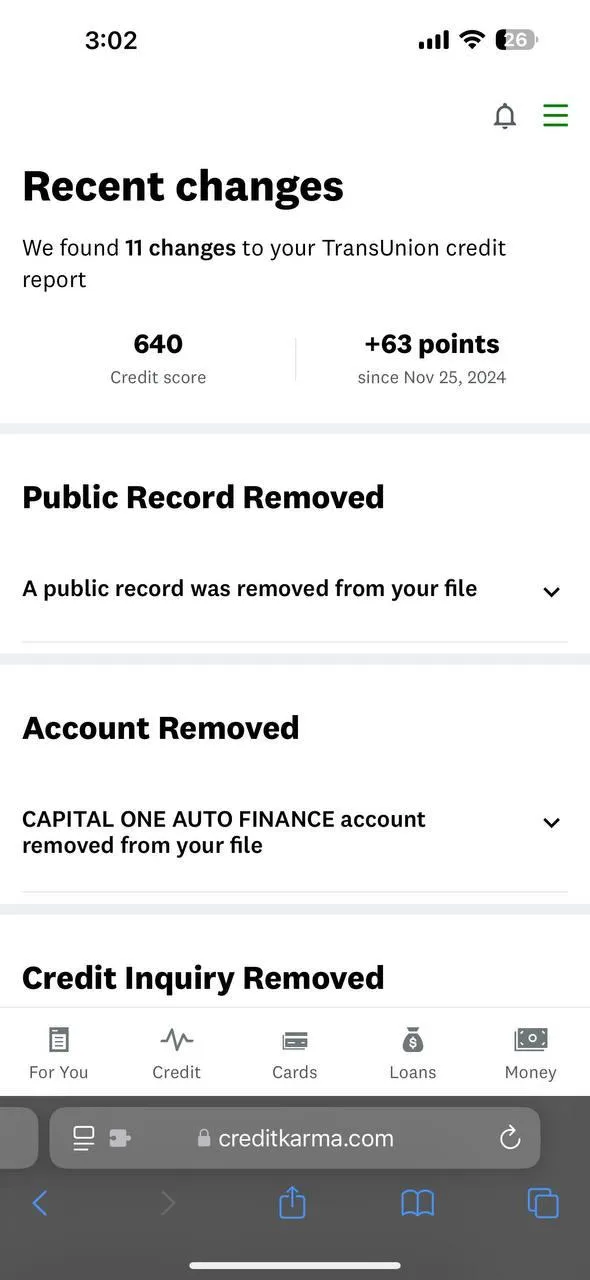

What We Remove

We work to remove inaccurate, unverifiable, and outdated negative items, including:

Late payments

Charge-offs

Collections

Foreclosures

Repossessions

Medical bills

Student loan lates

Bankruptcies (case by case)

Inaccurate personal information

Unauthorized inquiries

frequently asked questions

What do I need to qualify for business funding?

Ideally, a credit score of 680 or higher and proof of income or revenue. If you don’t qualify yet, we’ll guide you through the steps to get there.

Can I get funding even if my credit isn’t perfect?

Yes. Some funding options are available for clients with fair credit or a strong business profile. However, better credit means better terms — and we can help you improve it.

Do you offer both personal and business services?

Yes! We specialize in personal credit repair and business funding. Whether you’re looking to clean up your credit or secure capital to start or grow a business, we’ve got you covered.

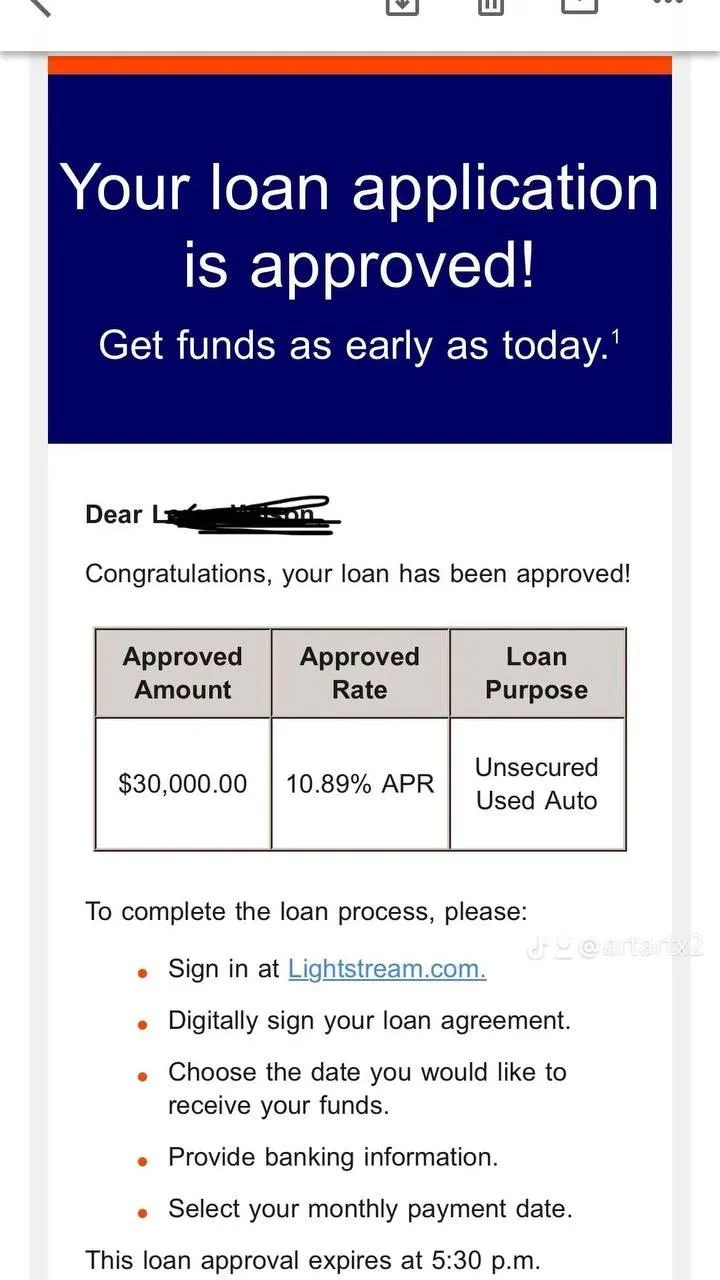

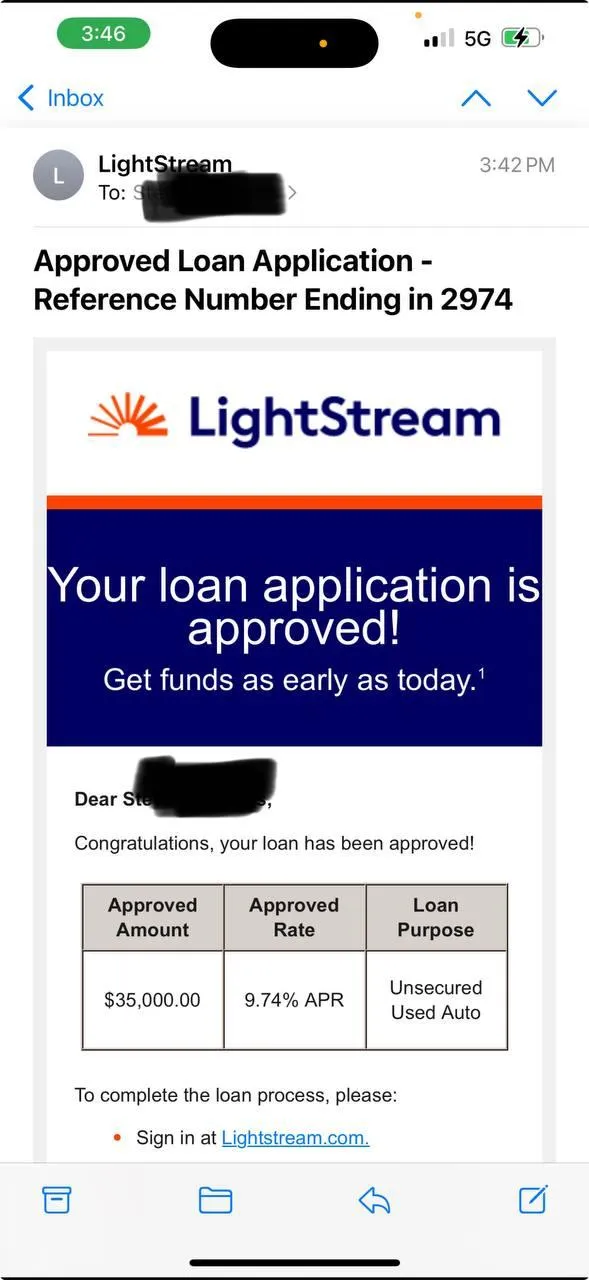

What kind of results can I expect with credit repair?

While every case is different, most clients see a significant improvement in their credit score and the removal of negative items like collections, charge-offs, and late payments.

How long does the process take?

Most credit repair clients see results within 45 to 90 days. Funding pre-qualification takes just a few minutes, and approvals can happen within 3–10 business days depending on the lender.

Is the funding really 0% interest?

Yes, many of our approved clients receive business credit lines with 0% interest for 6 to 12 months, depending on creditworthiness and lender terms.

What if I’m not sure where to start?

That’s okay! Just take our free pre-qualification quiz or book a free consultation. We’ll help you figure out the best next step based on your situation.

got questions?

We make it simple. You’ll find answers to the most frequently asked questions from our clients how we’re here to help you grow confidently.

Still don’t see the answer you’re looking for?

Send us a message to get your questions answered directly.

Your Success Story Starts Here

With hundreds of successful outcomes, we’re confident we can help you too.

Ready to be our next result?